1971: When Fiat Money Broke and Bitcoin Became Inevitable

The Nixon Shock, the Collapse of Bretton Woods, and the Rise of a Trustless Alternative

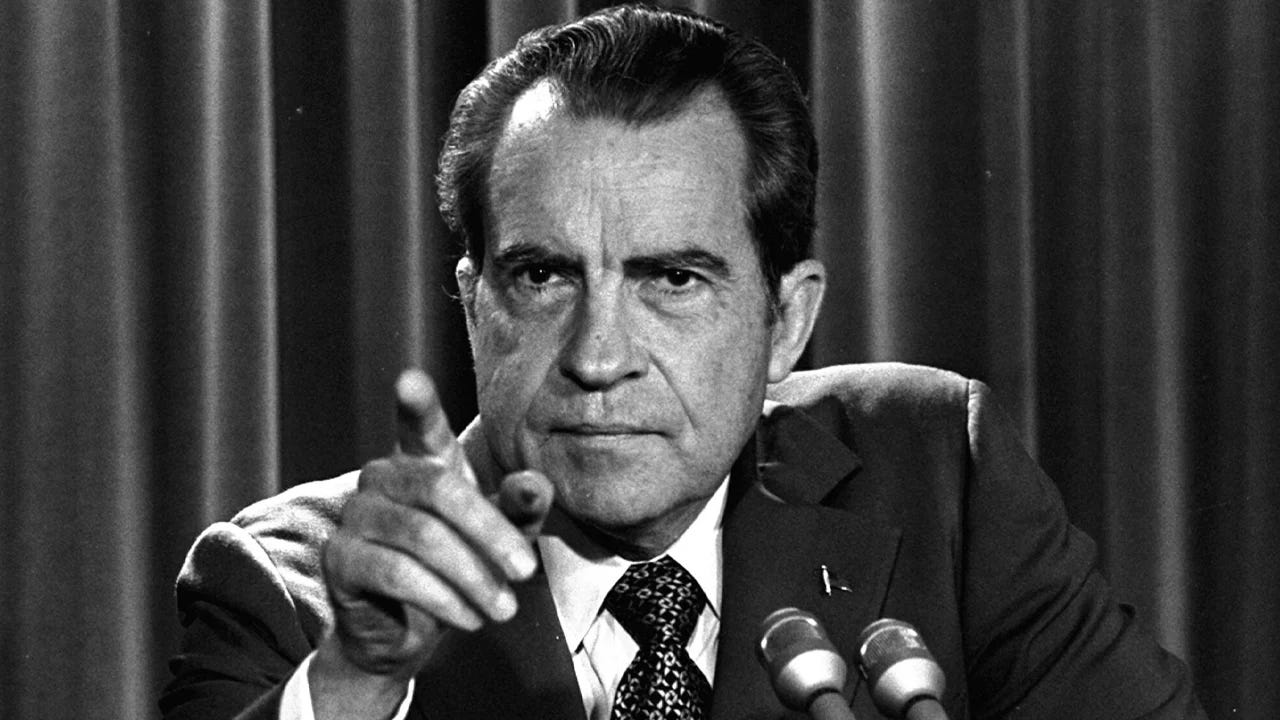

In 1971, the global financial system fractured, setting the stage for a monetary revolution that would culminate in Bitcoin’s creation nearly four decades later. On August 15, 1971, US President Richard Nixon announced a series of economic measures that ended the Bretton Woods system, severing the US dollar’s tie to gold. This pivotal moment, often dubbed the “Nixon Shock,” unleashed a new era of fiat money, currencies backed by government decree rather than tangible assets. The consequences of this shift, chronic inflation, currency devaluation, and eroded trust in institutions, planted the seeds for Bitcoin, a decentralised, trustless alternative that challenges the very foundations of fiat. This article explores how 1971 broke the monetary order and made Bitcoin’s emergence inevitable.

The Bretton Woods System: A Fragile Foundation

Established in 1944, the Bretton Woods agreement pegged global currencies to the US dollar, which was convertible to gold at $35 per ounce. This system aimed to stabilise international trade and prevent the currency wars of the interwar years. Nations held dollars as reserves, trusting the US to honour gold redemptions. However, by the late 1960s, cracks appeared. The US, funding the Vietnam War and Great Society programmes, printed dollars far beyond its gold reserves. Countries like France, wary of this overreach, began demanding gold for their dollar holdings, draining Fort Knox.

By 1971, the US faced a dilemma: devalue the dollar or abandon gold convertibility. Nixon chose the latter, announcing in a televised address that the US would “temporarily” suspend the dollar’s convertibility to gold. This wasn’t temporary, it was permanent. The Bretton Woods system collapsed, and currencies floated freely, untethered from any hard asset. The era of fiat money began, where the dollar’s value rested solely on trust in the US government and its central bank, the Federal Reserve.

The Fiat Fallout: Inflation and Eroded Trust

The end of gold backing unleashed a Pandora’s box of economic woes. Without the discipline of a scarce asset, governments and central banks could print money at will. The 1970s saw rampant inflation, with US consumer prices rising 7.1% annually on average, peaking at 13.5% in 1980. Purchasing power eroded; a dollar in 1971 is worth about 14 cents today. Globally, fiat systems mirrored this trend, with currencies losing value as governments financed deficits through money creation.

This inflation wasn’t just economic, it was psychological. Citizens lost faith in institutions promising stability. Savings dwindled, and wages lagged behind rising costs. The social contract frayed as central banks, unaccountable to the public, manipulated money supply to prop up economies. Meanwhile, the US dollar’s status as the world’s reserve currency, bolstered by the “petrodollar” system, where oil was priced in dollars, masked deeper flaws. The Eurodollar market, a shadow banking system of offshore dollar deposits, further decoupled money from accountability, amplifying financial instability.

The Seeds of Bitcoin: A Cypherpunk Response

The fiat system’s flaws didn’t go unnoticed. In the 1980s and 1990s, a group of cryptographers and activists known as cypherpunks began exploring digital solutions to restore monetary sovereignty. Inspired by works like David Chaum’s “eCash” and Adam Back’s “Hashcash,” they sought to create money free from central control. The 1971 shift had exposed fiat’s vulnerability: trust in governments could be weaponised. Cypherpunks envisioned a currency where trust was replaced by code, cryptography, and consensus.

Enter Satoshi Nakamoto. In 2008, amidst the global financial crisis—another fiat-fueled debacle, Nakamoto published the Bitcoin whitepaper. Bitcoin was a direct response to the post-1971 world: a decentralised, peer-to-peer currency with a fixed supply of 21 million coins, secured by proof-of-work (PoW). Unlike fiat, Bitcoin’s issuance follows a predictable schedule, immune to political whims. Its blockchain, a transparent ledger verified by nodes worldwide, eliminates the need for trusted intermediaries. The message embedded in Bitcoin’s genesis block—“Chancellor on brink of second bailout for banks”, was a nod to the failures of fiat systems, echoing the distrust born in 1971.

Why Bitcoin Was Inevitable

The Nixon Shock created a world where money became a tool of control, not a store of value. Bitcoin’s inevitability stems from three key flaws in the fiat system exposed in 1971:

Unrestrained Money Creation: Fiat’s lack of scarcity enables inflation, eroding wealth. Bitcoin’s 21 million cap enforces scarcity, mimicking gold’s discipline without its physical constraints. The halving mechanism, reducing miner rewards every four years, ensures supply growth slows, contrasting with fiat’s endless expansion.

Centralised Control: Central banks, like the Federal Reserve, wield unchecked power, manipulating rates and printing money to bail out banks or fund wars. Bitcoin’s decentralised network, with miners and nodes spread across geopolitically diverse regions, resists control. No single entity can alter its rules without consensus, a safeguard absent in fiat systems.

Eroded Trust: Post-1971, trust in institutions waned as promises of stability crumbled. Bitcoin’s “don’t trust, verify” ethos empowers users to audit the blockchain themselves, restoring sovereignty. Its cryptographic security, rooted in SHA-256 and elliptic curve cryptography, ensures transactions are unhackable without astronomical resources.

These flaws made a trustless alternative not just desirable but necessary. Bitcoin’s rise reflects a rejection of fiat’s broken promises, offering a system where rules are coded, not dictated.

Bitcoin’s Role in a Post-Fiat World

Today, Bitcoin’s relevance is clearer than ever. Inflation, reignited by post-2008 quantitative easing and pandemic-era stimulus, continues to erode fiat purchasing power. The US national debt, nearing $37 trillion as of June 2025, underscores fiat’s unsustainability. Meanwhile, de-dollarisation efforts, China, Russia, and others diversifying reserves into gold and Bitcoin, signal waning trust in the dollar’s hegemony. El Salvador’s adoption of Bitcoin as legal tender and MicroStrategy’s $21 billion BTC acquisition plan highlight its growing acceptance as a hedge against fiat collapse.

Bitcoin isn’t without challenges. Its volatility, driven by speculative trading, deters some. Scalability issues persist, though solutions like the Lightning Network enable faster, cheaper transactions. Privacy concerns linger, as Bitcoin’s pseudonymous ledger allows transaction tracing, but tools like CoinJoins enhance anonymity. Yet, these hurdles pale against fiat’s systemic flaws. Bitcoin’s fixed supply and decentralised governance offer a lifeline in a world where fiat’s fragility is increasingly exposed.

The Legacy of 1971: A Call to Action

The Nixon Shock of 1971 wasn’t just a policy shift—it was a betrayal of monetary trust. By unmooring money from gold, it unleashed a system that punishes savers, rewards debtors, and concentrates power. Bitcoin, born from the ashes of this broken system, is more than a currency; it’s a rebellion against centralised control. Owning even 0.1 BTC, worth $10,000 at a $100,000 price, places you among a global elite in a supply-constrained asset. As institutions and nations accumulate, waiting for a dip risks being priced out.

The lesson of 1971 is clear: trust in fiat is a gamble. Bitcoin offers an alternative where you verify, not trust. Start small, stack sats through dollar-cost averaging, secure your keys in cold storage, or run a full node to strengthen the network. The fiat system broke in 1971, and Bitcoin’s rise proves it can’t be fixed. The question isn’t whether Bitcoin will succeed, it’s whether you’ll be part of the revolution before it’s too late.