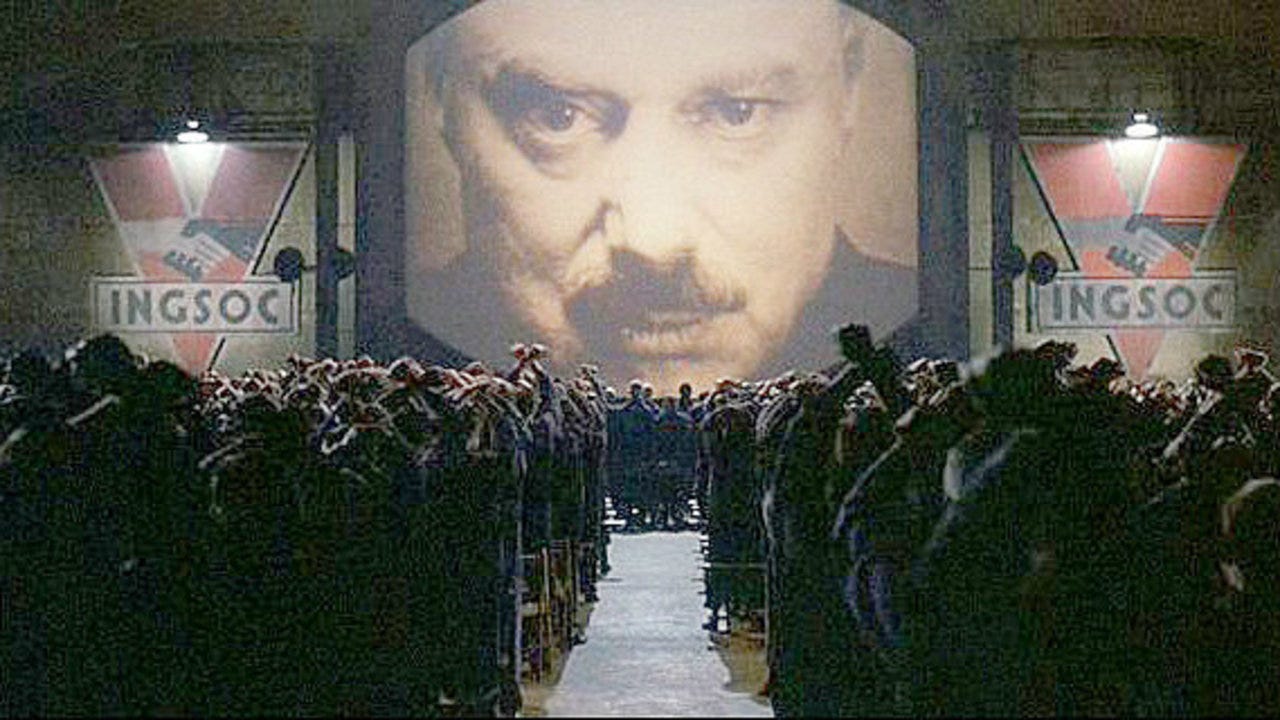

Central Bank Digital Currencies (CDBCs): progress or panopticon?

The promise and peril of Central Bank Digital Currencies

As digital finance becomes the default for billions of people, central banks around the world are quietly building, or actively rolling out, Central Bank Digital Currencies (CBDCs). On the surface, they sound like a natural evolution: a government-backed digital currency, issued and guaranteed by the central bank. But beneath the surface, there’s a growing divide. Are CBDCs a step forward for financial efficiency and inclusion? Or are they the on-ramp to a dystopian financial control grid, where every transaction is traceable, programmable, and, if desired, freezable?

Like most powerful technologies, CBDCs can be both revolutionary and dangerous. Here’s a breakdown of the key pros and cons, and why many believe their deployment isn’t just likely, it’s inevitable, especially during the next crisis.

✅ The pros: why governments are so interested

1. Payment efficiency & innovation

CBDCs could modernise payment systems, offering instant, secure, low-cost transactions, domestically and across borders. This could eliminate middlemen, settlement delays, and reduce friction for global commerce.

2. Financial inclusion

Billions remain underbanked. A well-designed CBDC could give anyone with a mobile phone access to secure digital money, bypassing the need for traditional bank accounts, especially in developing countries.

3. Faster monetary policy implementation

In a crisis, central banks could send stimulus directly to citizens via CBDCs, no waiting for cheques or bank processing. The government’s monetary “helicopter” could arrive in seconds, not weeks.

4. Transparency and anti-corruption

Digital transactions leave an auditable trail. CBDCs could reduce tax evasion, money laundering, and illicit finance, at least in theory. Transparency could help governments track how public money is used.

5. Resilience against stablecoins and crypto

As crypto adoption grows, governments fear losing control of monetary policy. A CBDC allows them to compete directly with decentralised alternatives like Bitcoin or privately issued stablecoins.

❌ The cons: a gateway to control?

1. Total surveillance of transactions

With every transaction recorded on a centralised ledger, CBDCs could erode financial privacy. Governments, or third parties, could theoretically monitor, analyse, or even manipulate your spending.

2. Programmable restrictions

CBDCs are “smart” money. Authorities could set rules: where you can spend, what you can buy, or how long your money is valid. Expiry dates on savings? Ban on purchases from certain merchants? Technically possible.

3. Censorship and financial deplatforming

In extreme cases, governments could freeze funds, block access, or impose penalties for politically unfavourable behaviour. It’s not theoretical, governments have already frozen bank accounts for dissenters. CBDCs would make it easier.

4. Systemic risk to banks

If people move funds from commercial banks into CBDCs en masse (especially during crises), it could destabilise traditional banking. The central bank could become the only safe place to store value, draining liquidity from the rest of the system.

5. Mission creep

What starts as “optional” and “harmless” could shift quickly. Over time, new regulations or social credit-style incentives could reshape how CBDCs are used. The more people rely on them, the harder it is to opt out.

🕵️♂️ The stealth rollout: crisis = catalyst

CBDCs are unlikely to arrive with a bang. Instead, they’ll be introduced quietly, during times of financial stress, a stealthy rollout under the guise of helping during a crisis. Imagine this: markets crash, traditional banks wobble, and the government swoops in with a CBDC-based rescue package. “Free money” in a convenient app. You just need to agree to a few terms, maybe KYC, maybe a digital ID, maybe biometric verification. It starts with a few strings. Then more.

By the time it’s widely used, it’s already deeply embedded.

🧭 Final thoughts: inevitable or avoidable?

CBDCs are coming. That much seems certain. The question is how they’ll be implemented, and what safeguards (if any) will exist. If designed with transparency, limited scope, strong privacy protections, and sctrict governance, CBDCs could complement existing systems without erasing freedom. But if introduced hastily, or with unchecked power, they could usher in the most powerful financial control system humanity has ever known: a Central Bank Dystopian Currency.

So: progress or panopticon?

Probably both.

The key is awareness. Because by the time most people realise what CBDCs truly are, they’ll already be using them.

If you enjoyed this article please hit ❤️, or share it with a friend who’s wondering where what CDBC’s mean for humanity. Thanks for reading.

The End Is Near … paper and coin will cease … and you Will Never See “The Gold” in Ft.Knox