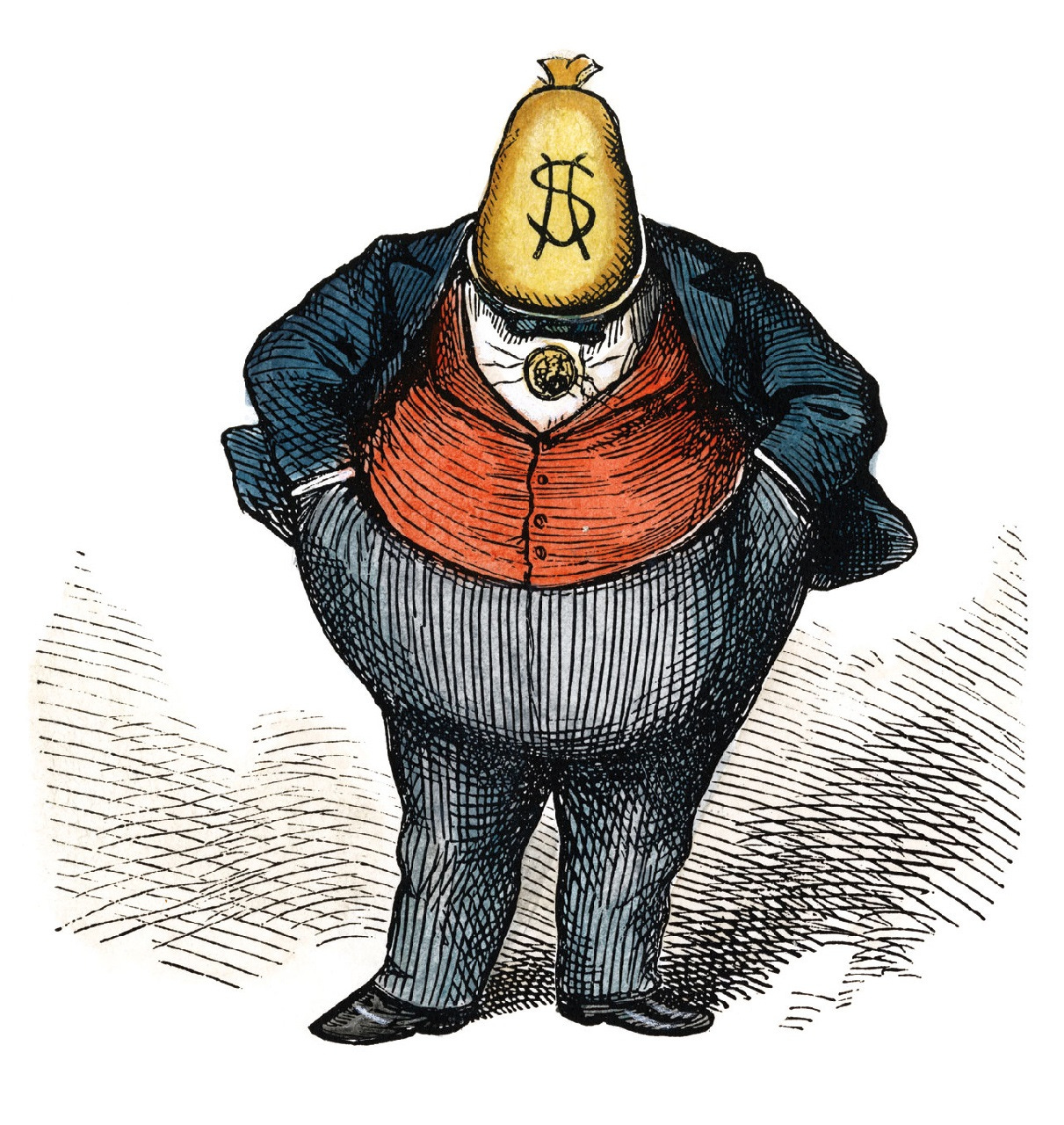

There is a theory circulating among financial circles known as The Great Taking. It is not a fringe idea and it is not about some distant possibility in a century’s time. It is a sobering scenario built on the legal, financial, and political realities that already exist in many countries today.

The core of the theory is simple. In the event of a major systemic crisis, whether triggered by a market collapse, a geopolitical shock, or a global emergency, the assets you believe you own could be reclassified as collateral for the debts of the financial system. In practice, that could mean stocks, bonds, retirement accounts, and even the home you live in could be seized or encumbered to protect the stability of the system.

We are told we own these things. Your house is “yours” if you have paid off the mortgage. Your brokerage account is “yours” because your name is on it. But legally, the structures underpinning asset ownership are more complex than most realise. Many securities are held in “street name” by custodians. Many property titles are ultimately registered through state systems that could be altered in a declared emergency. And nearly every major economy already has “bail-in” laws allowing the conversion of private assets to cover systemic losses.

In other words, ownership is not always the same as possession. If you cannot directly control and access it without permission from a third party, it is at risk.

This is where the implications for financial sovereignty become clear. If a systemic crisis large enough were to occur, governments and central banks would act in the interests of maintaining the system, not in preserving your individual holdings. The fine print in custodial agreements and the emergency powers already on the books mean the mechanics of such a taking would be legal, rapid, and final.

Gold, silver, and Bitcoin, when held in your own custody , operate outside of that custodial risk. They are not promises on a balance sheet, they are assets in your physical possession or in wallets you control. This is why those who value true sovereignty over their wealth prioritise them. They are portable, liquid in global markets, and do not depend on the solvency of a custodian to retain their value.

Even property, often thought of as the safest form of wealth, is not immune. Land and housing exist within the legal frameworks of the state. Title deeds, zoning rights, and tax obligations all create points of control that can be used to reassign ownership or impose conditions in a crisis. History is littered with examples of property confiscations and forced transfers in times of upheaval.

The unsettling truth is that we are only one calamity away from the potential enactment of such measures. It could be a banking crisis, a war, or an economic collapse. The trigger does not need to be global, even a regional shock could justify sweeping emergency powers.

That is what makes this so concerning. It is not the theory itself that is frightening, it is how easily it could become reality.

Financial sovereignty is not about paranoia, it is about understanding the difference between legal ownership and true control. The system has shown us, time and again, that in moments of crisis it will prioritise its own survival over the property rights of the individual. The time to prepare is not when the calamity strikes, it is now.

Hold assets you can control. Reduce exposure to intermediaries. Understand the legal framework of what you “own”. Because when the Great Taking comes, the question will not be whether you were invested wisely, but whether you actually held anything at all.

I’m glad you are aware of this and talk about it. Your posts are qualitative, keep on the good work