Virtue on Credit

How Governmental “Pathological Altruism” Spends Your Future Today (and Why Bitcoin Says “No”)

TL;DR: It’s easy to be virtuous with Other People’s Money (OPM). Governments call it compassion; accountants call it unfunded liabilities; citizens experience it as higher taxes, larger deficits, stealth inflation, and a more fragile economy. This is “pathological altruism”: policies that feel benevolent but, when scaled and politicized, quietly hurt the people they claim to help. A monetary system with hard constraints, hello, Bitcoin, shrinks the space for costless virtue-signalling and forces trade-offs back into the open.

The OPM Machine: Charity Without the Bill

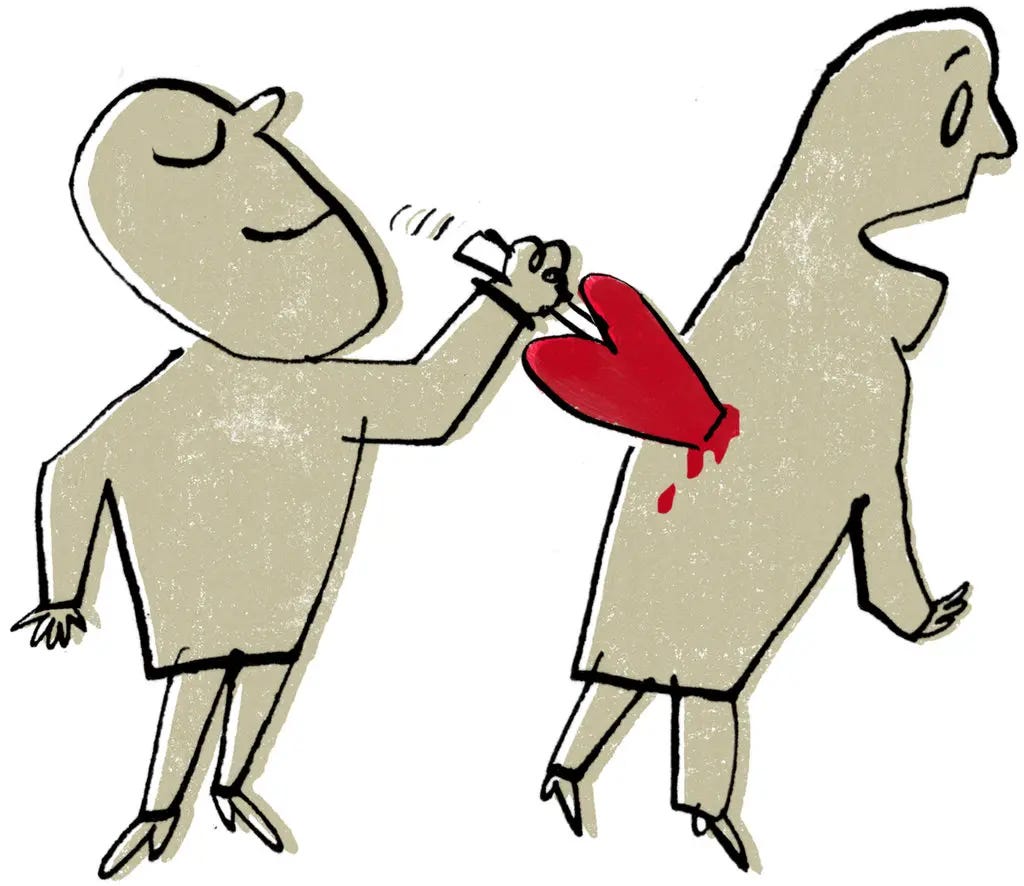

Being generous with your own wallet is hard. Being generous with mine is policy.

Government has three levers:

Tax now (visible pain),

Borrow now (visible later),

Print later (invisible now, chaotic later).

“Pathological altruism” thrives in number 2 and number 3. The benefits are concentrated and photogenic (“We helped!”); the costs are dispersed and time-shifted (“We’ll refinance the debt; inflation is transitory; trust the models”). Voters applaud the ribbon-cutting, not the bond auction.

How Good Intentions Go Bad at Scale

Pathological altruism isn’t malice, it’s misaligned incentives:

Samaritan’s Dilemma: When aid is permanent, dependency becomes rational.

Goodhart’s Law: Target the metric (graduation rates, “affordable” prices), and you’ll get the metric, often at the expense of the mission.

Moral Hazard: If failure is backstopped, risk-taking suddenly looks noble.

Cantillon Effect: Freshly created money hits insiders first (asset owners, creditworthy firms), with “compassion” trickling to everyone else after prices have already moved.

Small-scale charity learns and adapts; large-scale political charity calcifies and lobbies.

The Receipts: Where the Costs Hide

Taxes: The honest but unpopular route. Politicians prefer confetti, not co-pays.

Debt: Tomorrow’s taxes packaged as “stimulus”. The interest line item becomes the new welfare program, paid to bondholders.

Inflation: A universal, regressive tax, sold as “macro flexibility”. Wages chase prices; asset owners win the footrace.

The punchline: programs labelled “for the vulnerable” often transfer buying power from wage earners and savers to the already-asset-rich.

“But We Have to Do Something!”

We should, just not everything, all the time, with money we don’t have. Real compassion involves triage, sunset clauses, and feedback loops that punish failure. The modern “do something” ethos, funded by elastic money, turns every emergency into a forever program and every forever program into a constituency.

Why Bitcoin Changes the Conversation

Bitcoin doesn’t fix human nature. It does something more annoying (and therefore more useful to governance): it limits discretion.

Hard cap (21 million): You can’t print away trade-offs. Every new promise needs a payer now, not “later via CPI”.

Neutral issuance: No special window for insiders. No Cantillon queue.

Transparent settlement: Reserves, payments, and treasuries can be audited on-chain or at least benchmarked in a unit that can’t be diluted by policy.

Self-custody: Citizens can opt out of being the shock absorber for policy errors.

Under a hard-money constraint, “pathological altruism” shrinks because the currency refuses to underwrite vibes. You want a program? Great, raise taxes, cut elsewhere, or make the case to private donors and markets. No more compassion on layaway.

Objections, Pre-butted

“Bitcoin is volatile.” True, priced in a system being actively debased. Volatility is the market discovering a new base layer. Fiscal discipline won’t wait for your preferred Sharpe ratio.

“What about crises?” Hard constraints don’t ban aid; they ban limitless aid without cost. Emergencies still get funded, just transparently and with an exit ramp.

“Energy!” Monetary certainty has a cost. So does a rolling series of debt-financed “rescues” and asset bubbles. Pick your externality.

A Better Way to Do Altruism

Sunset + scorecards: Every program ships with a kill switch and hard metrics. Miss twice? Off the books.

Fund honestly: Taxes or bonds priced in hard money, not stealth debasement.

Local first: Push compassion to the edge where feedback is fastest and capture is hardest.

Proof-of-help, not press releases: Publish audited outcomes, not inputs.

The Quiet Revolution: Virtue With Skin in the Game

Bitcoin’s most subversive feature isn’t number-go-up, it’s excuses-go-away. When the currency can’t be willed into existence, governments (and voters) rediscover the adult art of prioritization. Compassion becomes costly again, meaningful again.

Because if your kindness requires a money printer, it’s not kindness. It’s credit.

And the bill always comes due. Hard money just insists we open it.