Why Bitcoin is different from every other cryptocurrency

Understanding Bitcoin’s unmatched position in the crypto landscape

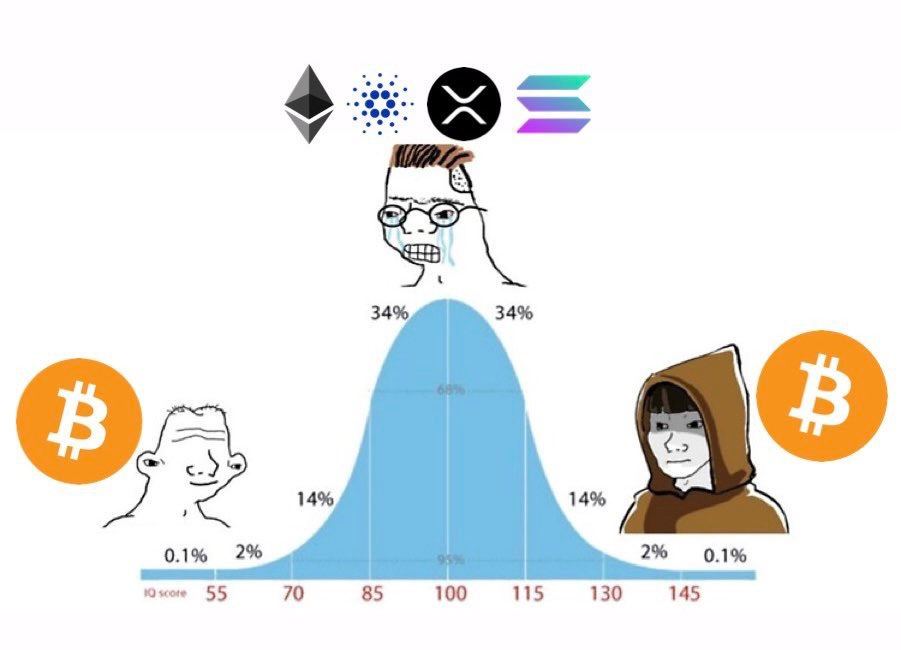

Over the years, we’ve seen endless newcomers enter the world of cryptocurrency. Many start with excitement about Bitcoin, only to quickly tumble down a rabbit hole of altcoins, Ethereum, Solana, XRP, Dogecoin, and countless others. But with time and understanding, a growing number of people come full circle, back to Bitcoin.

So what makes Bitcoin different? What makes it stand apart not just technically, but fundamentally, from every other coin out there?

This isn’t about tribalism. It’s about understanding why Bitcoin is singular, and why, for many, it's the only cryptocurrency that truly matters.

🚶 How people progress through Bitcoin

There’s a common pattern in how people explore the Bitcoin ecosystem:

“Wow, Bitcoin is amazing! How do I get some?”

“Mining sounds like where the money is, can I make Bitcoin myself?”

“Mining looks complicated…maybe I should just buy it.”

“Great, I have some Bitcoin, but what are all these other coins?”

“I should hedge, what if one of these other coins outperforms Bitcoin?”

“There are too many to research. I’ll just buy the most popular ones.”

“These new coins are cheaper, maybe they’ll moon!”

At some point, many stop on this path. Some only ever mine. Others hold Bitcoin and ignore altcoins. Some diversify across everything. But the common thread is this: almost everyone questions whether Bitcoin truly is different, or just the first.

Let’s dig into that.

⚖️ Why people buy altcoins

There are usually three reasons people hedge into altcoins:

Bitcoin might fail, and another coin could succeed where it falls short.

An altcoin might offer better utility, becoming more useful than Bitcoin.

There’s room for niche use-cases, even if Bitcoin remains dominant.

Let’s tackle each.

💥 Could Bitcoin suffer a catastrophic failure?

Yes, in theory. Like any technology, Bitcoin isn’t immune to bugs or attacks.

But let’s look at the types of potential failures:

Technical flaw: A bug in the code or a vulnerability in Bitcoin’s cryptography. While possible, this risk also applies to most altcoins, many of which are based on the same codebase or use the same cryptographic algorithms.

Economic flaw: A failure in monetary policy, such as a sudden supply increase. However, Bitcoin’s rules are hardened and require consensus to change.

Consensus failure: The network splits in two due to disagreement. This has happened before (e.g., Bitcoin Cash), but Bitcoin itself remained intact.

In reality, Bitcoin has proven more resilient than any other coin. Bugs have been patched swiftly. Splits have been resolved through market choice. Most importantly, Bitcoin has no central leader, making it resistant to top-down manipulation.

Altcoins, by contrast, often have centralised teams, founders, or foundations who can (and do) change monetary policy, code, or even history.

🛠 What about altcoin innovation?

Many altcoins promote their so-called “superior tech”: faster transaction speeds, smart contracts, greater anonymity, improved scalability, and so on. Fair enough, some do experiment with features that Bitcoin does not currently possess.

But here’s the catch: Bitcoin can adopt valuable innovations, whether natively or through second-layer solutions such as the Lightning Network or sidechains. And if a feature proves genuinely useful in the real world, developers and entrepreneurs can build it around Bitcoin, without changing the core protocol.

In essence, Bitcoin is capable of absorbing innovation over time. What it refuses to do is recklessly implement unproven features that could undermine its security or decentralisation. So altcoins aren’t just competing with Bitcoin, they're also competing with the entire ecosystem of builders innovating on top of it..

🧱 Niche use-cases: is there room for others?

Some coins attempt to carve out niche purposes:

Dogecoin for tipping.

Monero for privacy.

Ethereum for smart contracts.

Ripple for interbank transfers.

But most of these niches can be (and are being) addressed by solutions built on or around Bitcoin. Take privacy: innovations like CoinJoin, Lightning Network, and FediMint are making real progress. Tipping? Done via Lightning. Smart contracts? Coming to Bitcoin via tools like RGB or Taro.

Bitcoin is slower to evolve, yes, by design. It prioritises stability, decentralisation, and censorship resistance over rapid iteration.

🔒 Bitcoin’s unique properties

Here’s why Bitcoin is categorically different:

Truly decentralised: No central team, company, or founder.

Hardest money ever created: Fixed 21 million supply. No inflation.

Most secure network: Backed by immense proof-of-work hashing power.

Most credible monetary policy: No rug pulls. No pre-mines.

Most decentralised development: No single entity controls the code.

First-mover advantage and brand trust: Recognised and trusted globally.

No other cryptocurrency comes close on all fronts.

🎯 Final thoughts: Bitcoin isn’t just the first, it’s fundamentally different

Bitcoin isn’t competing in the same race as altcoins.

While others prioritise features, flash, or market cap gains, Bitcoin focuses on trustlessness, resilience, and long-term credibility. It's not trying to be everything. It's trying to be the best money the world has ever known.

You may explore altcoins. You may even profit from them.

But eventually, many realise the truth:

There is Bitcoin…and then there’s everything else.

If you enjoyed this article please hit ❤️, or share it with a friend who’s deep into some random altcoin. Show them the light, with Bitcoin. Thanks for reading.